Mobile wallets are growing in popularity due to their convenience and simplicity of usage. Pakistan’s #1 mobile wallet, Easypaisa, allows money transfers, bill payments, and mobile top-ups.

The Easypaisa smartphone app is popular, but you may establish an account without it. This post will show you, “How to open an Easypaisa account without the app?” so you may use its services even without a smartphone.

Use Easypaisa Account Without App

Before creating an Easypaisa account without the app, you must comprehend its offerings. Easypaisa Mobile Account provides a convenient way to access financial services through your mobile phone.

It allows you to perform various transactions, including money transfers, bill payments, mobile top-ups, and more. Opening an Easypaisa mobile account offers flexibility and accessibility to a wide range of financial services.

Also read about, “How to change my mobile number in my Easypaisa account?” Ensuring an easy change and account security.

1. Eligibility for Opening an Easypaisa Mobile Account

To establish an Easypaisa mobile account, you must qualify. Requirements are:

- Age requirements: Open an Easypaisa mobile account if you’re 18 or older.

- Valid CNIC: The National Database and Registration Authority (NADRA) must issue a valid CNIC.

- Mobile Phone: You need a working phone in your name.

- Valid SIM Card: Your phone’s SIM card should not be registered under someone else’s CNIC.

- Pakistani resident: Easypaisa mobile accounts are only available to Pakistanis.

2. Documents Require to open an Easypaisa account without the app?

To complete the account opening process, you will need to provide the following documents:

- CNIC Copy: A clear and valid photocopy of your CNIC is required for verification purposes.

- Passport Size Photograph: You need to provide a recent passport-size photograph.

- Proof of Address: A utility bill or any official document indicating your current residential address is necessary.

Visit Easypaisa Retailer to Open a Mobile Account

Once you meet the eligibility criteria and gather the required documents, follow these steps to open an Easypaisa mobile account:

- Visit an Easypaisa Retailer: Locate the nearest Easypaisa retailer or Telenor franchise.

- Provide Required Information: Provide your CNIC copy, photograph, and proof of address to the retailer.

- Account Registration: The shop will help you register your account.

- Biometric Verification: You’ll need biometric verification to prove your identity.

- Confirmation and Activation: After verification, you will get a confirmation mail containing account information and activation instructions.

- Set Your PIN: Create a secure 4-digit Easypaisa mobile account PIN by following the instructions.

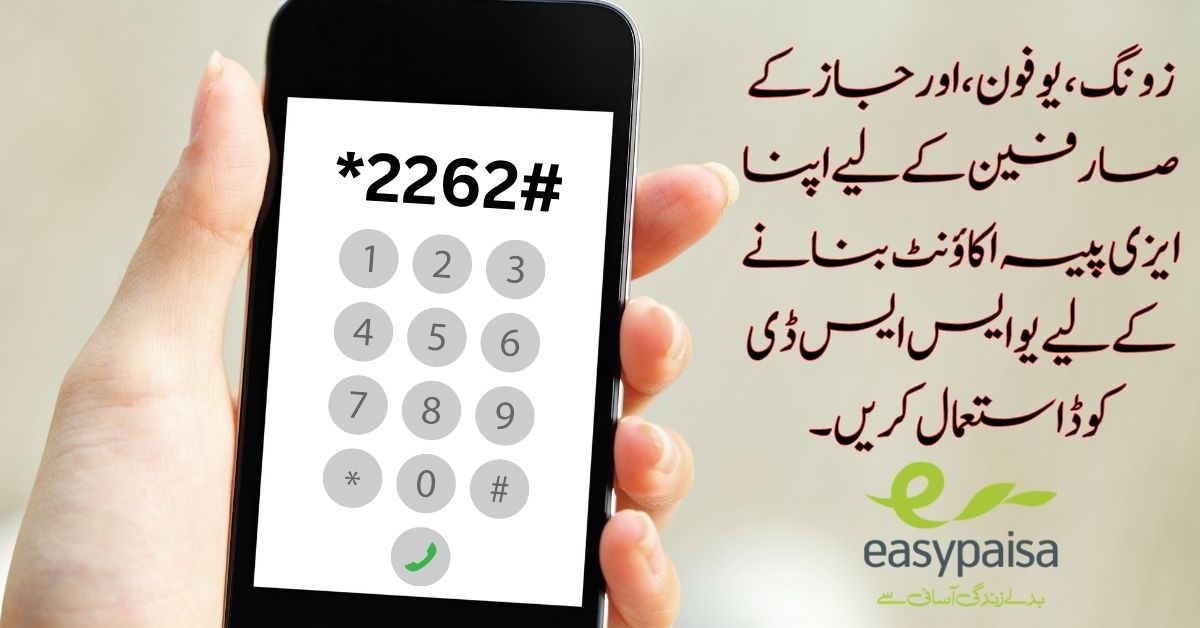

Use the USSD code to create your Easypaisa account, if you can’t install the app.

For Telenor Customers:

1. Dial *786#

2. Enter your CNIC and Date of Issuance

3. Create a 5-digit PIN Code.

4. Confirm your PIN Code and log in to Easypaisa mobile.

For Zong, Ufone, and Jazz Customers:

1. Dial *2262#

2. Enter your CNIC and Date of Issuance

3. Create a 5-digit PIN Code.

4. Confirm your PIN Code and log in to your Easypaisa mobile account.

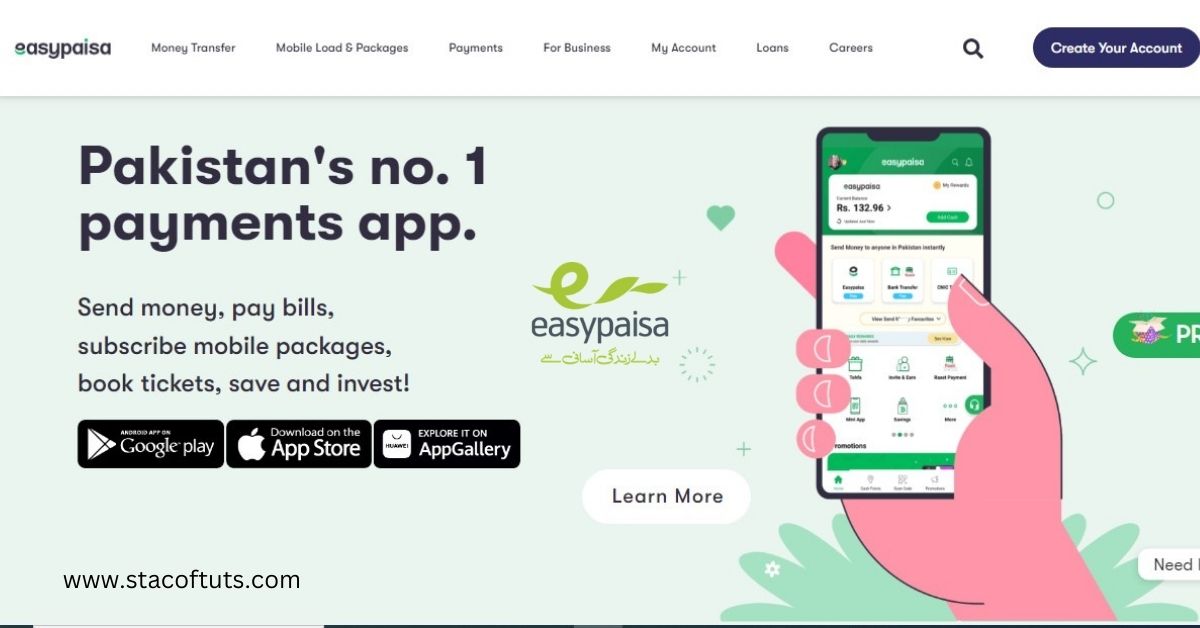

Visit the Easypaisa website to open Mobile Account

You must visit the Easypaisa website to establish an account without using the mobile app. Open your preferred web browser and search for “Easypaisa website” to find the correct page.

- Click “Create Account”: Find the “Create Account” or “Register” button on Easypaisa. Account creation begins with this button.

- Register CNIC number: Identify Yourself To establish an Easypaisa account, you must submit your complete name, CNIC number, cellphone number, and email address. Make sure your information is correct and current.

- Verify Mobile Number: Easypaisa will issue a One-Time Password (OTP) to your cellphone number when you register. Enter the OTP in the designated field on the website to verify your mobile number.

- Create a PIN: Next, you’ll be asked to generate a four-digit Easypaisa PIN. Choose a distinctive, easy-to-remember PIN that’s hard to guess.

- Accept Terms and Conditions: Before proceeding, carefully read through the terms and conditions of using Easypaisa. Once you have reviewed them, check the box to accept the terms and conditions.

- Complete the Verification Process: To ensure the security of your account, Easypaisa may require additional verification. This could include providing a scanned copy of your CNIC, proof of address, or other relevant documents. Follow the instructions provided to complete the verification process.

- Fund Your Easypaisa Account: After successfully creating your Easypaisa account, it’s time to fund it. You can load funds into your account through various methods, such as visiting an Easypaisa retailer, using online banking services, or transferring funds from your existing bank account.

- Explore Easypaisa Services: Congratulations! You’ve successfully opened an Easypaisa account without using the app. Now, take some time to explore the wide range of services offered by Easypaisa, including money transfers, bill payments, mobile top-ups, online shopping, and more.

Who can be an Easypaisa mobile account subscriber?

Easypaisa Mobile Account subscription is open to individuals who meet the following criteria:

1. Residents of Pakistan:

To become an Easypaisa Mobile Account subscriber, you must be a resident of Pakistan. Non-residents are not eligible to subscribe to an Easypaisa Mobile Account.

2. Active Mobile Phone:

To subscribe to an Easypaisa Mobile Account, you need to have an active mobile phone registered in your name. The mobile phone will be linked to your account and serve as the primary device for account access and transactions.

3. SIM Ownership:

The SIM card associated with your mobile phone should be registered under your own name and CNIC. SIM cards registered under someone else’s name or CNIC are not eligible for an Easypaisa Mobile Account subscription.

FAQs:

No, you cannot open more than one Easypaisa mobile account. Easypaisa’s policy allows individuals to have only one mobile account, ensuring a fair and secure banking experience. Opening multiple is not permitted to maintain transparency and prevent misuse of the system.

If you already have a CNIC account, you cannot register a new Easypaisa mobile account. Easypaisa prevents users from creating multiple accounts with the same CNIC to assure compliance and avoid abuse. Use your current Easypaisa account or contact customer support for help.

Easypaisa mobile account creation may be difficult if your CNIC has expired. Easypaisa needs a current CNIC for account verification and compliance. Before creating an Easypaisa mobile account, renew your CNIC. Renew your CNIC and create an Easypaisa mobile account by visiting the NADRA office or contacting the required authorities.

Conclusion

In today’s digital age, opening an Easypaisa account without the app is both feasible and straightforward. By leveraging alternative methods like SMS or visiting an authorized agent, users can ensure financial flexibility. Such options make Easypaisa’s services accessible even to those without a smartphone. Embracing these methods bridges the gap between technology and convenience.

Thanks!